- Patent

- Trademark

- Innovation

- SolutionsAI

- Contact

- Learn & Support

- Learn and support

- Webinars & EventsAre you interested in attending one of our online or onsite event?

- Product TrainingsCustomer success is our priority. Increase your skills in the use of Questel’s software

- Product NewsA platform dedicated to software and platforms news and evolutions

- Best-in-class Customer ExperienceOur goal is to exceed our clients' expectations and share best practices

- IP TrainingIncrease the IP-IQ of your entire organization with engaging IP training programs

- Newsletter subscriptionSign up for our quarterly patent and trademark newsletters and set your email preferences below.

- Webinars & Events

- Resource HubStay up-to-date with industry best practices with our latest blogs

- Resource Hub

- About Questel

- Learn & Support

- Learn and support

- Webinars & EventsAre you interested in attending one of our online or onsite event?

- Product TrainingsCustomer success is our priority. Increase your skills in the use of Questel’s software

- Product NewsA platform dedicated to software and platforms news and evolutions

- Best-in-class Customer ExperienceOur goal is to exceed our clients' expectations and share best practices

- IP TrainingIncrease the IP-IQ of your entire organization with engaging IP training programs

- Newsletter subscriptionSign up for our quarterly patent and trademark newsletters and set your email preferences below.

- Webinars & Events

- Resource HubStay up-to-date with industry best practices with our latest blogs

- Resource Hub

- About Questel

Moving Parts: What Competitive Patent Landscape Analysis Tells Us About Watch Innovation

The wristwatch technical domain is in constant evolution. Samuel Da Costa, Consultant in Business Intelligence, reveals key findings from Questel’s competitive patent landscape analysis of innovation in watch internal parts, including movement mechanisms, precisions components, and timekeeping features.

Even though wristwatches have been worn for centuries, this is a sector that continues to evolve and innovate. Questel’s landscape analysis of the wristwatch technical domain has identified several important patent trends, from protection for internal moving parts to the main industry players. Here, we discuss some of our key findings, as an example of how our IP Consulting services, including competitive patent landscape analysis, can support companies to maximize their patent assets, especially in innovation hotspots.

A Moment in Time: IP Origin and Dynamics

There are a total of 5,494 patented inventions related to the internal parts of timepieces. The graphs below provide an overview of the IP trends related to watch internal parts, including information on legal status, filing dynamics, and research and development (R&D) countries.

The fact that slightly over 1% of patents were opposed or litigated suggests that the level of aggression among players in this industry is not noteworthy.

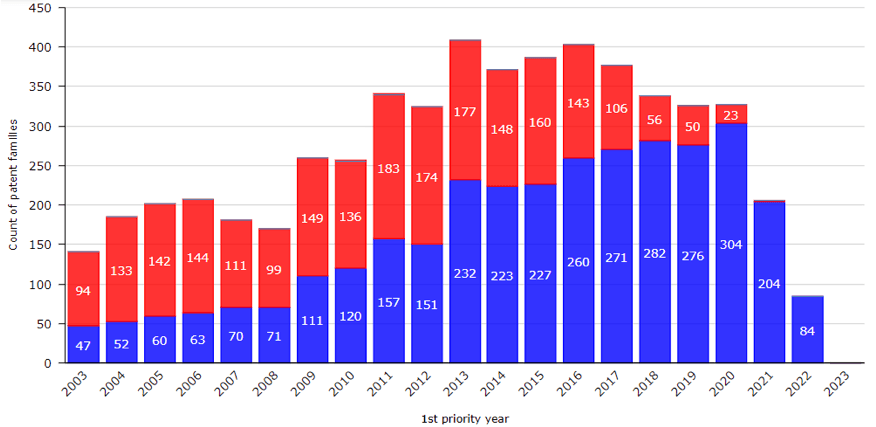

As detailed in the chart below, IP activity in this sector has been in existence for a considerable time (dating back to before 2003) and has experienced a marginal compound annual growth rate (CAGR) of 3%, which is comparatively lower than the global average growth rate during the same period (11% CAGR).

(The years 2021 to 2023 are incomplete due to the 18-month publication delay.)

Keeping time: Markets and investments

The first patent application in a family can indicate the geographical position of the applicant or, more particularly, the location of their R&D hubs. At a macroscopic level, it highlights the main countries generating R&D in the searched technical domain.

As shown below, R&D in this technical domain is mostly coming from China (CN, 35%), Switzerland (CH, 21%) and European Patent countries (EP, 15%).

Similarly, the number of documents published in the various national IP offices reflects the patent strategies of the actors in the sector, as national filings are a good indicator of the markets that need to be protected. Note, however, that some players also target protection in the geographical areas where the manufacturing sites of their competitors are located. The marked coverage map below is based on patent publication numbers in the different offices.

China, Europe (mostly Switzerland), Japan and the U.S. are the main markets of interest in the domain of timepiece internal parts. The ratio of PCT applications is notably low.

Who Are the Top Actors?

Our top player analysis is based on the parent company, with patent assignees that belong to the same company amalgamated, for example:

- Swatch: Breguet, ETA, Blancpain, Omega, Nivarox

- LVMH: Hublot, Zenith, Bulgari, TAG Heuer

- Richemont: Cartier, IWC, A. Lange & Söhne, Montblanc, Panerai, Piaget, and Vacheron Constantin

With almost 2,300 families, the top 15 players own more than 42% of the IP, 39% for the top 10. These ratios are strikingly high, indicating that the number of innovative companies developing novel solutions in this domain is limited.

The main historic players are Swatch, Seiko, Richemont, Patek Philippe, Citizen Watch, LVMH, Rolex, Sowind, Audemars Piguet, and Casio. The main newcomers are the Chinese players Seagull, Hangzhou Watch, Chijiu Watch, Sunon, and Peacock Clock.

Assessing Patent Portfolio Value

We assessed patent portfolio value through the following criteria:

- Velocity: Number of patent families over the last five years, divided by five.

- Technology Impact: Score based on the number of citations received by the analyzed patent families. Corrected for age.

- Market strategy: Score based on the GDP of the countries where the analyzed patent families have been granted or are pending.

This competitive patent landscape analysis of metrics focused on players of interest allows us to directly compare them according to the metrics widely used to judge IP portfolio quality.

Swatch leads Seiko and the other players by quantity, velocity, and the number of families in force. Rolex is well positioned with a more cited and better extended patent portfolio.

Networks and Collaborations

A portfolio that is strongly cited by most players is likely to be a pioneering or a blocking portfolio. This graph below illustrates the number of citations between applicants, identifying portfolios that have strong interactions with each other.

It reveals a strong citation cluster in this technological domain, especially around Swatch. The concentration of citations around this player indicates the influence it builds in the technical domain; possibly by disclosing disruptive/cornerstone inventions.

Moreover, there is a clear technical interdependence between the main players in this technical field (Swatch, Seiko, Rolex, Richemont and Patek Philippe). It shows a mature or maturing technology, where innovation spaces (white spaces) are becoming scarcer, especially when the industry starts to define better solutions.

Technology, Concepts, and Applications

The chart below displays the most frequently employed concepts within the field of timepiece internal parts. It can serve as a source of inspiration for new advancements or help identify patented technologies in emerging areas.

Pointer, oscillation, alarm clock and pinion are the key concepts associated with patents related to internal part of timepieces. With an average annual growth rate of 55%, the Tourbillon oscillation technology is one of the most trending subtopics.

Time to find out more? Contact our specialist IP Consulting team to find out more about competitive patent landscape analysis in the wristwatch or any other sector.

Samuel Da Costa is a Consultant in Business Intelligence at Questel.